Do You Need Immediate Assistance with a Recent Bill?

If you have recently been hospitalized or hit with significant medical expenses, our Debt Jubilee Project cannot help -- but we know who can!

CLICK HERE to connect to DollarFor and find out what charity care is available from your hospital!

How Debt Collection Works

We’re all familiar with how debts are collected. After a few months without payment, the creditor will often engage a debt collection agency to contact the debtor and seek payment. When debts, whether medical or otherwise, have aged to a certain point without payment (even after traditional debt collection), creditors in many cases will sell the debt off to a third-party collection agency, which purchases the debt at a steep discount. The third party then has the legal right to collect the full amount of the debt even though they only paid pennies on the dollar for it. This is known as “factoring.”

This is where Undue Medical Debt steps in. The founders had worked for years in the financial collections industry, and they realized that they could come in and purchase the unpaid medical debts for a pittance — not with the intent of collecting on them, but with the intent of forgiving the debt in full. They organized a system where donations can be used to purchase these debts, usually for a penny on the dollar. They set up a system that would evaluate the need of the debtors, targeting poorer families for whom the debt was an impossible burden,

Who Qualifies?

Undue Medical Debt has strict requirements for the debt that can be purchased. One (or both) of the following requirements must be met:

- Household income is less than 4x the federal poverty level (varies by state, family size).

- Debts are 5 percent or more of annual income.

While individual debts are verified to be part of the portfolio purchase, we cannot target specific families or individuals. This is basically a wholesale approach to medical debt which requires purchase of a large portfolio of debts.

How Forgiveness Works

The Debt Jubilee Project has partnered with Undue Medical Debt to purchase and forgive crippling medical debts in central North Carolina. Families or individuals will be notified by an official letter that their debt ha been purchased and forgiven. The debt will be removed from their credit reports; the forgiveness will have no tax implications for the recipients.

Debt Jubilee Project

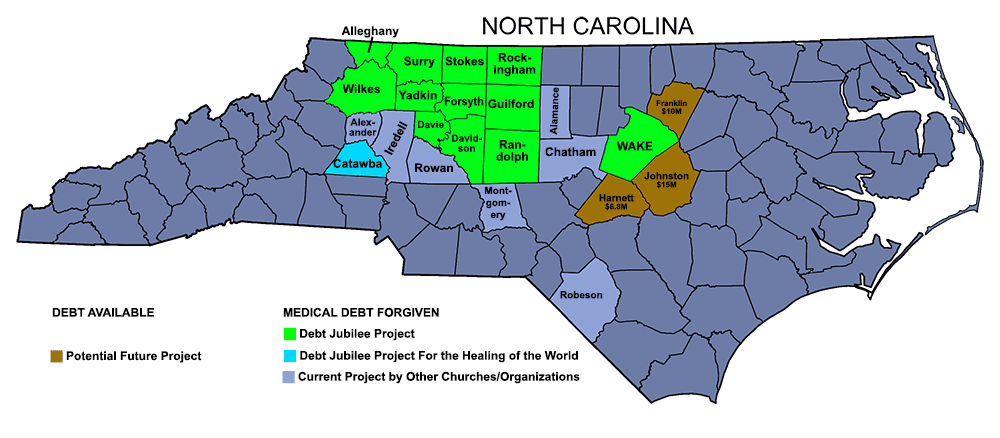

This will be an ongoing project; our first campaign in August of 2022 rasied $5,000 and was able to abolish over million dollars in existing medical debt in Forsyth County. Since then we have abolished debts in Davidson, Davie, Yadkin, Randolph, Rockingham, Alleghany, Guilford, Surry, Wilkes, Stokes, and Wake counties.

Our campaign continues, and has expanded to include advocacy for policy. Since Atrium and Novant, the domnant health care systems in central NC, have decided to no longer sell medical debt, our initial approach is somewhat crippled. However, we will be supporting the NC Medical Debt De-Weaponization Act and other policy changes which will help poor and middle class people struggling with medical debt.