A Senate report claims that UnitedHealth Group used “aggressive risk-adjustment coding tactics” to increase U.S. government reimbursement for patients enrolled in its Medicare Advantage healthcare plans,

News

News items.

Private Equity Firms Destroying Hospitals

The New Republic recently ran a story about how private equity firms buy hospitals, extract the capital, and then walk away from the remains:

The Private Equity Firms That Gobble Up Hospitals and Spit Them Out

Looking to turn a quick profit, the firms buy medical facilities and then unload them just a few years later, often leaving devastation in their wake.

The article, written by Sara Degregorio, profiles the death throes of Crozier-Chester Medical Center in Pennsylvania, once a vital and respected general hospital. Purchased in 2010 by Prospect Medical Holdings (in turn owned by Leonard Green Associates), the new owners cut staff, didn’t maintain equipment or purchase new equipment, sold the property off to a real estate company and leased the building back to the CCMC, which had previously owned the property and buildings outright.

“When Leonard Green exited Prospect Medical in 2021, the Rhode Island attorney general investigated and found that the ownership group “realized hundreds of millions of dollars and would leave behind a system that is highly leveraged, that is, where liabilities greatly exceed assets.” Prospect Medical continued to own Crozer-Chester until the company closed that hospital and others amid the company’s bankruptcy in 2025, leaving residents with nowhere to go for care.”

Read more about other hospitals closed by Prospect Medical Holdings.

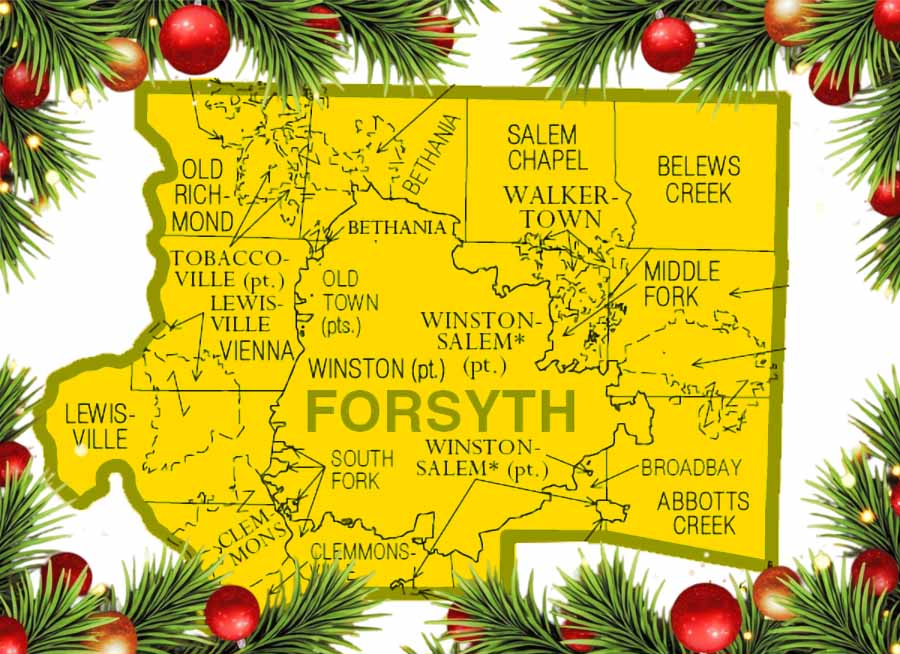

2025 Christmas Campaign Underway!

Our 2025 Christmas Campaign will run from December 14, 2025 to January 15, 2026. We are seeking to raise at least $15,000 to purchase and forgive $1.7 million in medical debts owed by our neighbors in Forsyth county. However, our CHALLENGE GOAL is $30,000 to buy up all the qualifying debt that has been released recently due to the HASP Plan. This will be our 8th campaign, and the first where we were not able to buy all the available debt in Forsyth county. Help us hit our challenge goal! We encourage other Forsyth churches to chime in with our campaign — or start their own! We need to help our neighbors, and this is now a proven way to directly help those who have been victimized by a broken health care financing system.

To donate directly to this campaign by credit card, please click here:

DEBT JUBILEE PROJECT – CHRISTMAS 2025 CAMPAIGN

If you wish to donate by check, please make sure to inlcude the specified campaign in the Memo Line:

Payable To:

Undue Medical Debt

Address:

Undue Medical Debt

P. O. Box 411675

Boston, MA 02241-1675

Memo Line:

Trinity Moravian Church — 68733

Jubilee Project Surges Past Goal – AGAIN!

Our Summer 2025 Debt Jubilee Campaign aimed to raise $15,000 to purchase past-due medical debts in FORSYTH, GUILFORD, DAVIE, DAVIDSON, and STOKES counties – totaling $2,980,086! Overflow would be used to purchase debts in nearby Surry, Yadkin, and Wilkes counties.

We closed the campaign on September 15 with a total of $21,118.40 – 140% of our goal! We will be announcing the final total of debts abolished at our service on Sunday, November 2, when we will also hold our ceremonial Debt Burning.

Little-Known Appeal Could Force Your Insurer to Pay for Care.

When a health insurer refuses to pay for your treatment, you may have the right to have the denial reviewed — and potentially overturned — by an independent provider. Duaa Eldeib of ProPublica has compiled six steps experts suggest to help you through the external appeal process.

This Little-Known Appeal Could Force Your Insurer to Pay for Lifesaving Care. Here’s How to File It.

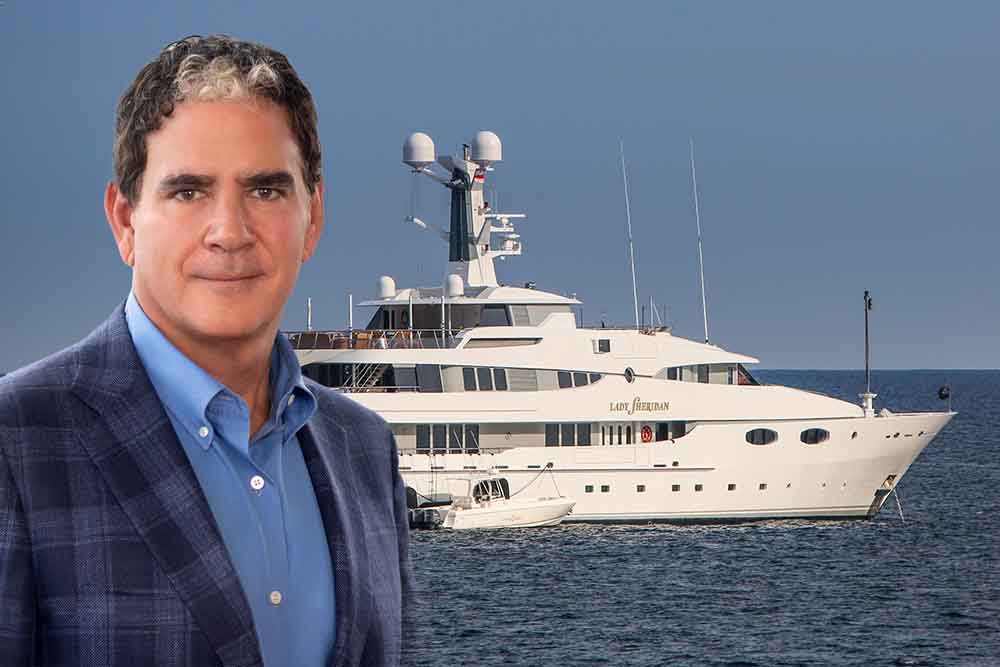

Bankrupt Steward Health Sues Former CEO

PHOTO: Dr. Ralph de la Torre, former CEO of Steward Health Care, and the Amaral (formerly “Lady Sheridan), his 190-foot superyacht, valued at $40 million, featuring six bedrooms, accommodations for up to 15 crew members, a gym, and various living and dining areas. This yacht’s operational costs are estimated at $4 million annually.

Steward Health Care has sued its former CEO and other leaders for misappropriation of assets, blaming the hospital chain’s bankruptcy on financial mismanagement and intentional looting of the assets. CBS News reports:

Steward Health Care claims former executives’ “greed and bad faith misconduct” led to hospitals chain’s bankruptcy

Background:

Steward Health Care, once the largest privately-owned hospital network, famously filed for Chapter 11 bankruptcy in May 2024 with about $9 billion of debt – leaving many areas without a hospital or with insufficient health care. A court approved its plan to liquidate by selling assets and pursuing lawsuits against former executives and other insiders to raise funds.

We reported on the closure and controversy:

Steward Health Care Declares Bankruptcy Amid Controversy

Lawsuits Against Former Executives:

The company alleges ex-CEO Ralph de la Torre and three other insiders misappropriated $245–262 million through excessive dividends, overpaid acquisitions (e.g., $205 million overpay for Miami hospitals), and diverting assets to personal entities—moves the company says left it “perpetually undercapitalized”

Feasibility of repayment through litigation:

Steward’s legal plan—backed by creditors—anticipates recovering at least 13% of claims. Even that modest recovery would cover all administrative and professional fees (lawyers etc.) of over $100–270 million, with actual expected recoveries between $800 million–$3 billion. This financial recovery will do little to help the cities and rurla areas that have been left without sufficient health care.

The privatization of struggling hospitals began in the 1990s, and in many cases has resulted in controversial moves by private equity to strip assets, sell off the properties and lease them back to the hospital at usurious rates which result in major profits for the equity company but often result in decreased service and even the failure of the institution. About 1/4 of the emergency rooms in the US are now owned by private equity firms.

AI Helps Appeal Denied Medical Insurance Claims

Insurance denials seem to be a persistent reality – even when the medical need seems clear. Many initial denials are in fact generated by a computer algorithm — so now there is a company that has trained an AI large language model to help write appeals – with significant success.

NBC News did a story recently on Claimable, a company founded by a team of healthcare and insurance insiders, data scientists and technologists who are committed to challenging the 850 million denied U.S. health claims each year uisng the same technology insurance companies do to minimize expenses. They follow the case of Stephanie Nixdorf in Davidson, NC and her successful appeal of denials.

Watch the story here:

AI is helping patients fight insurance company denials

Claimable website:

Getclaimable.com

Jury Rules Against Blue Cross Louisiana

Blue Cross authorized mastectomies and breast reconstructions for women with cancer but refused to pay the full doctors’ bills. A jury called it fraud and awarded the practice $421 million.

Read the full article on ProPublica:

“Slow Pay, Low Pay or No Pay”

Quick Summary:

-

Blue Cross Green-lighted, then underpaid: Blue Cross Blue Shield of Louisiana (“BCBSLA”) approved over 7,800 mastectomies and breast reconstruction surgeries—but paid just 9% of the billed charges for them, averaging roughly $43 million on $500 million billed.

-

Jury verdict: In September 2024, a Louisiana jury found BCBSLA committed fraud by authorizing procedures without ever intending full payment. They awarded the Center for Restorative Breast Surgery and St. Charles Surgical Hospital $421.5 million .

-

Insurance tactics:

-

BCBSLA maintained that prior authorization didn’t guarantee payment and often bundled payments without provider agreement .

-

They flagged the center on “Targeted” and “Blocked” provider lists, which triggered deeper scrutiny and payment cuts.

- Thousands of pre-authorized claims were never paid at all.

- BCBSLA received a “kickback” reward from other BCBS when it paid less for out-of-state patients..

-

Notably, BCBSLA signed one-off deals to fully cover treatment specifically for the wives of their own executives — highlighting inconsistent practices .

-

Atrium and Medical Debt – The Guardian

UK-based newspaper The Guardian has published an extensive article about Advocate Health (owner of Atrium Health and other hospital systems). Advocate is now one of the largest health care systems in the country, the result of multiple mergers and acquisitions. Atrium has had a number of embarrasing stories published about their aggressive collection tactics; in 2023 they ceased selling off debt to third party collectors – or debt abolishment organizations such as Undue Medical Debt. When Governor Cooper announced his plan last summer to encourage hospitals to forgive unpayable medical debts — mostly owed by people who would have had Medicare had it been expanded – Atrium and its parent fought the plan vigorously, only agreeing at the last moment. However, after agreeing, Advocate/Atrium set about a media campaign to gain good PR about how they were generously forgiving debts and removing liens placed on homes during their aggressive collection efforts. An exposé by NBC profiled an example of an older lien, which embarassed the hospital chain into removing some liens that fell outside the Governor’s program. NBC later followed up on the expanded forgiveness program. In many cases, debtors had made regular payments but ballooning interest debt meant that after many years of payments, they still owed almost the same – or more – than was originally financed.

However, extensive concerns remain about Advocate/Atrium’s billing and collection practices. The focus of the organization, mostly led by financiers and insurance executives, seems to be maximizing cash flow and constant expansion. Critics say that the bureaucracy is top-heavy and overpaid, resulting in high costs for medical treatment. Former NC State Treasurer Dale Folwell published a report in 2021 that Atrium’s spending on charity care equaled less than 60% of the value of the tax breaks it received as a non-profit. Advocate/Atrium and the Charlotte-Mecklenburg Hospital Authority are governed by state statutes from 1943, which never envisioned the corporatization that is occurring today.

Read the full article:

Photo of Atrium Health hospital in Charlotte, North Carolina by Jesse Barber/The Guardian

Jubilee Project Surges Past Goal

The Christmas 2024 Debt Jubilee Project had set a fundraising goal of $15,000 to purchase available medical debt in 12 NC counties. On January 17, 2025, the Winston-Salem Journal reported that we had exceeded the goal — ultimately raising $25,000 by the close of the project. Funds over the original goal will be used state-wide to abolish qualified medical debts in other counties. The final total of debts relieved will be announced on Sunday, February 9, 2025, when the church will hold a ceremonial “debt burning” to symbolize the elimination of the debts.

The Christmas 2024 Debt Jubilee Project had set a fundraising goal of $15,000 to purchase available medical debt in 12 NC counties. On January 17, 2025, the Winston-Salem Journal reported that we had exceeded the goal — ultimately raising $25,000 by the close of the project. Funds over the original goal will be used state-wide to abolish qualified medical debts in other counties. The final total of debts relieved will be announced on Sunday, February 9, 2025, when the church will hold a ceremonial “debt burning” to symbolize the elimination of the debts.