A Senate report claims that UnitedHealth Group used “aggressive risk-adjustment coding tactics” to increase U.S. government reimbursement for patients enrolled in its Medicare Advantage healthcare plans,

Medicaid

Private Equity Firms Destroying Hospitals

The New Republic recently ran a story about how private equity firms buy hospitals, extract the capital, and then walk away from the remains:

The Private Equity Firms That Gobble Up Hospitals and Spit Them Out

Looking to turn a quick profit, the firms buy medical facilities and then unload them just a few years later, often leaving devastation in their wake.

The article, written by Sara Degregorio, profiles the death throes of Crozier-Chester Medical Center in Pennsylvania, once a vital and respected general hospital. Purchased in 2010 by Prospect Medical Holdings (in turn owned by Leonard Green Associates), the new owners cut staff, didn’t maintain equipment or purchase new equipment, sold the property off to a real estate company and leased the building back to the CCMC, which had previously owned the property and buildings outright.

“When Leonard Green exited Prospect Medical in 2021, the Rhode Island attorney general investigated and found that the ownership group “realized hundreds of millions of dollars and would leave behind a system that is highly leveraged, that is, where liabilities greatly exceed assets.” Prospect Medical continued to own Crozer-Chester until the company closed that hospital and others amid the company’s bankruptcy in 2025, leaving residents with nowhere to go for care.”

Read more about other hospitals closed by Prospect Medical Holdings.

Bankrupt Steward Health Sues Former CEO

PHOTO: Dr. Ralph de la Torre, former CEO of Steward Health Care, and the Amaral (formerly “Lady Sheridan), his 190-foot superyacht, valued at $40 million, featuring six bedrooms, accommodations for up to 15 crew members, a gym, and various living and dining areas. This yacht’s operational costs are estimated at $4 million annually.

Steward Health Care has sued its former CEO and other leaders for misappropriation of assets, blaming the hospital chain’s bankruptcy on financial mismanagement and intentional looting of the assets. CBS News reports:

Steward Health Care claims former executives’ “greed and bad faith misconduct” led to hospitals chain’s bankruptcy

Background:

Steward Health Care, once the largest privately-owned hospital network, famously filed for Chapter 11 bankruptcy in May 2024 with about $9 billion of debt – leaving many areas without a hospital or with insufficient health care. A court approved its plan to liquidate by selling assets and pursuing lawsuits against former executives and other insiders to raise funds.

We reported on the closure and controversy:

Steward Health Care Declares Bankruptcy Amid Controversy

Lawsuits Against Former Executives:

The company alleges ex-CEO Ralph de la Torre and three other insiders misappropriated $245–262 million through excessive dividends, overpaid acquisitions (e.g., $205 million overpay for Miami hospitals), and diverting assets to personal entities—moves the company says left it “perpetually undercapitalized”

Feasibility of repayment through litigation:

Steward’s legal plan—backed by creditors—anticipates recovering at least 13% of claims. Even that modest recovery would cover all administrative and professional fees (lawyers etc.) of over $100–270 million, with actual expected recoveries between $800 million–$3 billion. This financial recovery will do little to help the cities and rurla areas that have been left without sufficient health care.

The privatization of struggling hospitals began in the 1990s, and in many cases has resulted in controversial moves by private equity to strip assets, sell off the properties and lease them back to the hospital at usurious rates which result in major profits for the equity company but often result in decreased service and even the failure of the institution. About 1/4 of the emergency rooms in the US are now owned by private equity firms.

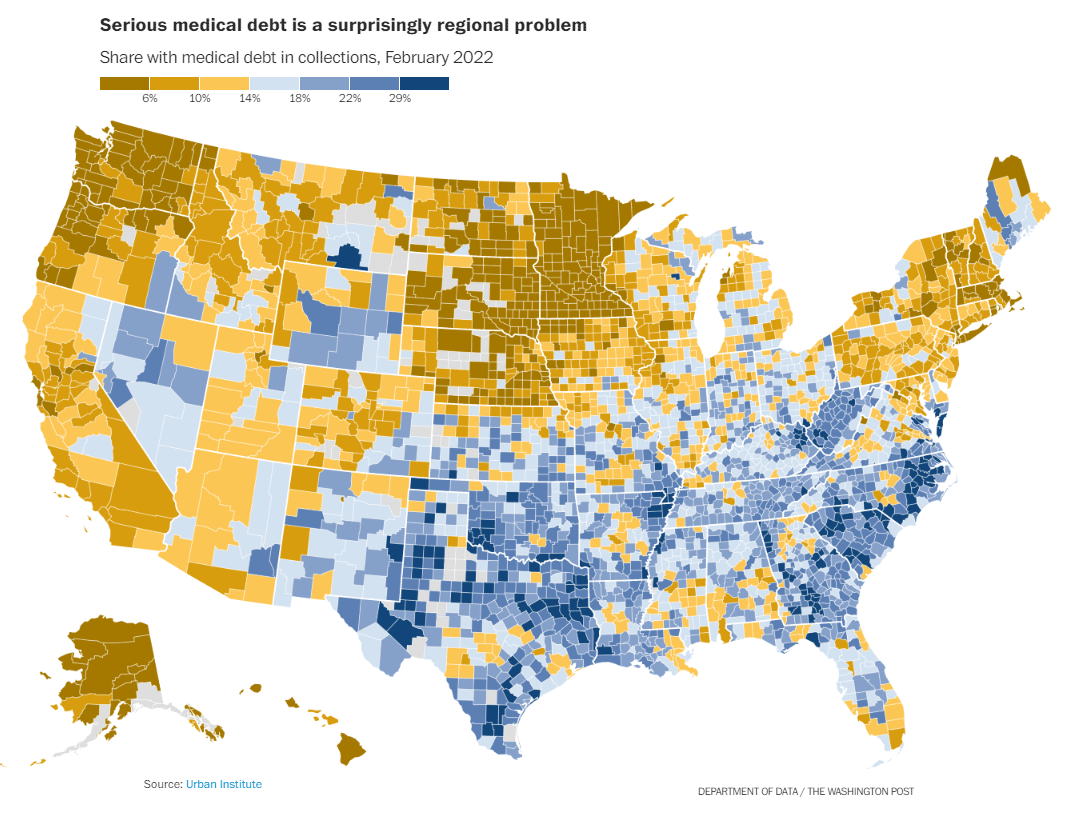

Serious Medical Debt a Regional Problem

Washington Post analyst Andrew Van Dam, in an article on regional debt scores, reports that serious medical debt is concentrated in the South and Appalachian regions. This coincides with maps of lower credit scores — and also a lack of non-profit medical systems reported in another article on May 15. The area generally matches the CDC’s “Diabetes Belt” as well. Graphic ©WashPo.

Read the article (scroll down to find section one medical debt):

NC Medicaid Expansion Delayed – Again

May 26, 2022: The NC House declined to act on the Senate’s proposed Medicaid expansion act, proposing their own version instead. Their proposal calls for yet another study, then for legislators to come back to Raleigh in December — after this fall’s election — for the actual vote approving the changes to the Medicaid program.

Read about it in NC Health News:

House speaker adds another Medicaid expansion plan to the mix