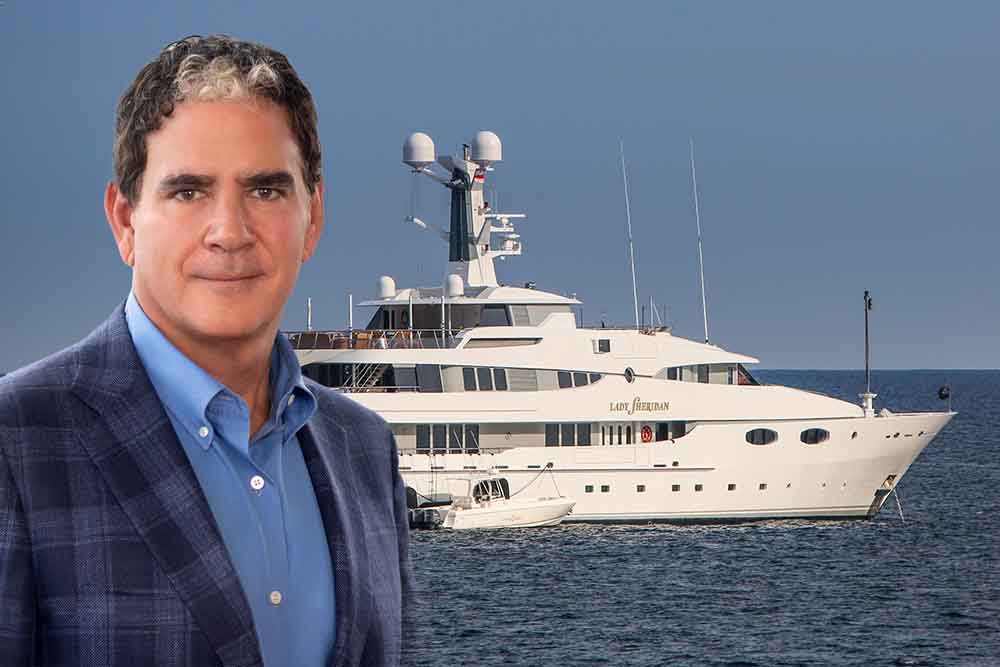

PHOTO: Dr. Ralph de la Torre, former CEO of Steward Health Care, and the Amaral (formerly “Lady Sheridan), his 190-foot superyacht, valued at $40 million, featuring six bedrooms, accommodations for up to 15 crew members, a gym, and various living and dining areas. This yacht’s operational costs are estimated at $4 million annually.

Steward Health Care has sued its former CEO and other leaders for misappropriation of assets, blaming the hospital chain’s bankruptcy on financial mismanagement and intentional looting of the assets. CBS News reports:

Steward Health Care claims former executives’ “greed and bad faith misconduct” led to hospitals chain’s bankruptcy

Background:

Steward Health Care, once the largest privately-owned hospital network, famously filed for Chapter 11 bankruptcy in May 2024 with about $9 billion of debt – leaving many areas without a hospital or with insufficient health care. A court approved its plan to liquidate by selling assets and pursuing lawsuits against former executives and other insiders to raise funds.

We reported on the closure and controversy:

Steward Health Care Declares Bankruptcy Amid Controversy

Lawsuits Against Former Executives:

The company alleges ex-CEO Ralph de la Torre and three other insiders misappropriated $245–262 million through excessive dividends, overpaid acquisitions (e.g., $205 million overpay for Miami hospitals), and diverting assets to personal entities—moves the company says left it “perpetually undercapitalized”

Feasibility of repayment through litigation:

Steward’s legal plan—backed by creditors—anticipates recovering at least 13% of claims. Even that modest recovery would cover all administrative and professional fees (lawyers etc.) of over $100–270 million, with actual expected recoveries between $800 million–$3 billion. This financial recovery will do little to help the cities and rurla areas that have been left without sufficient health care.

The privatization of struggling hospitals began in the 1990s, and in many cases has resulted in controversial moves by private equity to strip assets, sell off the properties and lease them back to the hospital at usurious rates which result in major profits for the equity company but often result in decreased service and even the failure of the institution. About 1/4 of the emergency rooms in the US are now owned by private equity firms.